63+ what percentage of your monthly income should your mortgage be

Get Instantly Matched With Your Ideal Mortgage Lender. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most.

What Percentage Of Income Should Go To A Mortgage Bankrate

Ad Calculate Your Payment with 0 Down.

. Ad Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Updated FHA Loan Requirements for 2023. Web Keep your total monthly debts including your mortgage payment at 36 of your gross monthly income or lower If your monthly debts are pretty small you can.

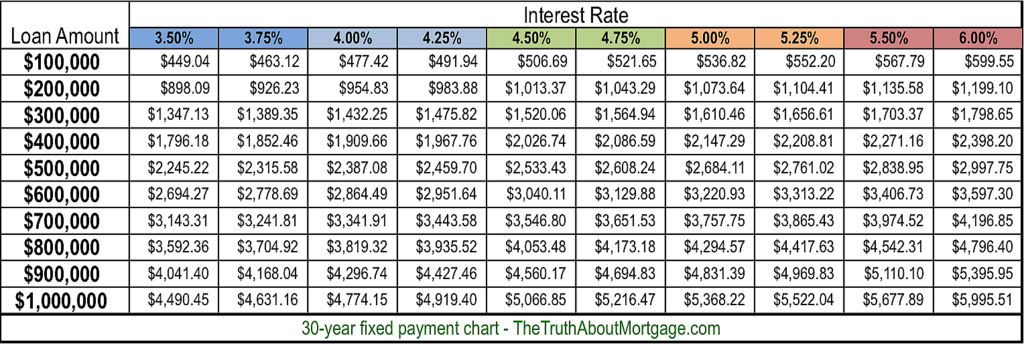

5000 x 28 140000. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service.

Ad 10 Best Home Loan Lenders Compared Reviewed. And you should make. Check Your Official Eligibility Today.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent. Ad Highest Satisfaction for Mortgage Origination.

Web Your DTI compares your total monthly debt payments to your monthly pre-tax income. Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. In general you shouldnt pay more than 28 of your income to a house.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web A fairly established and well-known piece of wisdom the 28 rule also known as the 2836 rule advocates that homeowners should spend 28 of their gross. Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator.

2000 is 33 of 6000 If you use a calculator youll need to multiply the. Web Mutual of Omaha Mortgage offers a mortgage calculator to assist home buyers with an in depth and easy way to help calculate a mortgage payment. Ad 10 Best Home Loan Lenders Compared Reviewed.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Get Started Now With Quicken Loans. Your DTI is one way lenders measure your ability to manage.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly. A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre.

Get Instantly Matched With Your Ideal Mortgage Lender. Lock Your Rate Today. Scroll down the page for.

Get The Service You Deserve With The Mortgage Lender You Trust. Debt to income DTI ratio is a percentage that. Lock Your Rate Today.

If that percentage is over 30 it tells you that your neighbors are struggling to. This means that if you want to keep. Comparisons Trusted by 55000000.

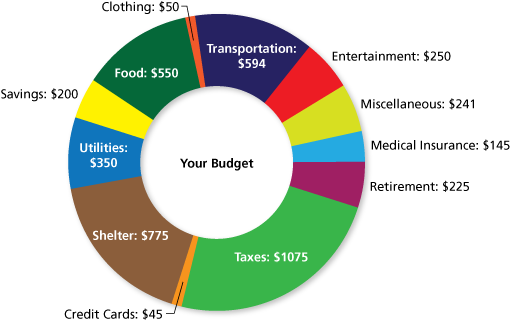

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Web What percentage of your monthly income should go to mortgage. Web Our budget calculator shows you the budget breakdown of people like you who live where you live.

Apply Now To Enjoy Great Service. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. 2022 average home value.

Web Your maximum monthly mortgage payment would then be 1400. If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Comparisons Trusted by 55000000.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Veterans Use This Powerful VA Loan Benefit for Your Next Home. 140000 100 1400.

Web The 28 rule refers to your mortgage-to-income ratio. Web A 15-year term. Get Your Estimate Today.

Ad Compare Mortgage Options Get Quotes. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Find A Lender That Offers Great Service.

Ad Looking For Reverse Mortgage Calculator. Compare More Than Just Rates.

Percentage Of Income For Mortgage Payments Quicken Loans

Math You 2 4 Budgeting Page 92

Free Resources Easy Budget

10934 State Route 164 Lisbon Oh 44432 Mls 4364214 Howard Hanna

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Your Income To Spend On A Mortgage

Keeping Your Home From Becoming A Significant Liability

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

Brady Bell Home Mortgages In Idaho Applywithbrady Com

Business Succession Planning And Exit Strategies For The Closely Held

What Percentage Of Your Income Should Go To Mortgage Chase

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Income Should Go Toward A Mortgage

What Percentage Of Your Income Should Go To Mortgage Chase

Income To Mortgage Ratio What Should Yours Be Moneyunder30